70-year-old Israel “Izzy” Englander, worth $6 billion to date, was born the same year as the state of Israel, and just one year after his parents escaped Nazi Europe. His parents landed in New York after Englander’s father’s family was wiped out entirely during the Holocaust. Englander was lucky enough to have grown up in Brooklyn, New York where he picked up a passion for the stock market early on. Englander studied finance at New York University, interned at Oppenheimer & Co. as well as the New York Stock Exchange and began working at Kaufmann, Alsberg & Co before starting his own brokerage firm – I.A. Englander & Co. in 1977. Eight years later, he teamed up with John Mulheren Jr. to make Jamie Securities Co., which failed after the firm dealt with some legal troubles. Englander tried again in 1989, creating Millennium Management LLC with partner Ronald Shear. Shear dropped out after a tough year, but Englander stayed on. Today the firm makes over 2 million trades per day with a team of 1200 traders and a staff of 1100. The fund says it aims to produce small gains on winning days and smaller losses on losing days in an effort to consistently get positive returns for investors.

How did this investing king approach biotech stocks Amarin (AMRN) and Bausch Health (BHC) in the third quarter? Let’s take a closer look:

Letting AMRN Swim Away

Hedge fund manager and big-time investor Israel “Izzy” Englander made some stock moves during the third quarter and investors might be wondering what’s behind it. Specifically, Englander disposed of 1,855,351 shares of Amarin stock, worth about $34,372,000 and around 47% of his AMRN holding.

The third quarter was a particularly exciting time for Amarin investors with shares shooting up by over 400%. But that could be only the beginning. In fact, Jeffries’ analyst Michael Yee thinks Amarin’s stock could nearly double from current levels over the next 12 months. The analyst reiterated an Outperform rating with price target of $30.00, which implies over 130% upside from current levels.

Amarin has been on a roller coaster since releasing data for fish oil drug Vascepa during a presentation called REDUCE-IT at the Chicago American Heart Association convention in November. The data was overwhelmingly applauded by doctors at the conference and 87% said they planned to prescribe the medication to patients with cardiac issues. There’s always dissenters, however, and some who analyzed the data questioned if the trial had used an appropriate placebo pill. The medical community questioned how accurate the study was and even suggested the results were exaggerated. It seemed like the saga was over, but just a month later the European Medicines Agency declared Omega-3 fatty acids to be an ineffective way to treat cardiac issues. Omega-3 fatty acid is a large component of fish oil, which is the main ingredient in the Vascepa pill.

The EMA is now forcing companies to remove labels that suggest Omega-3 fatty acids are beneficial to those with heart issues. Following the news, AMRN stock took a bit of a dive, even though the ruling does not apply to Vascepa being that the pill is not even available in Europe.

Yee ignored the noise, saying he considers AMRN “one of the few de-risked standalone blockbuster drugs in the small-to mid-sized market.”

“Given pullback from highs of $23 and down to $15 as broader equity markets fall, we think AMRN will bounce and go back up on 2019 catalyst path from scripts and sales ramp to FDA approval and/or wild-card M&A takeout…the more de-risked nature also theoretically gives less downside in volatile markets,” Yee concluded.

Analysts don’t seem to share the same sentiment with Englander. TipRanks analytics shows all five analysts who are watching over AMRN stock are bulls. The consensus price target of $34.80 shows a potential upside of just under 149% upside. (See AMRN’s price targets and analyst ratings on TipRanks)

Taking on BHC

While he flushes AMRN, Englander opens a new position of 518,934 shares for Bausch Health totaling around $13,321,000.

Just as BHC is about to take on Synergy Pharmaceuticals (SGYP), so is Englander taking on BHC. SGYP is on the road to being taken over by BHC due to the company going bankrupt. BHC is involved in a stalking horse offer, picking up SGYP and giving it a trial run before an official auction. During this time, BHC will be working to assume SGYP’s top drug, Trulance, which is designed to alleviate digestion issues for people who suffer from irritable bowel syndrome (IBS) and constipation.

The responses from those who have an opinion on the matter seem to be quite the mixed bag. Some say the medication was never a star and won’t be one under new supervision either. H.C. Wainwright’s analyst Ram Selvaraju, however, sees this as an opportunity for BHC to highlight SGYP’s drugs that have potential. The analyst even upgraded his rating for BHC from Neutral to Buy along with a raise in price target from $25 to $58. (To watch Selvaraju’s track record, click here). He explains his position:

“[…] we believe that Bausch Health is likely to view Synergy’s pipeline as ripe for development and rife with possibilities—chief among these would be the potential for dolcanatide, Synergy’s second-most advanced candidate, to complement Relistor in the opioid-induced constipation (OIC) arena. The Salix group has already created an interesting one-two message with Relistor and Lucemyra; we believe that the pairing of Xifaxan with Trulance could generate an unprecedented synergistic approach to treating disorders of lower gastrointestinal (GI) tract motility,” Raghuram concluded.

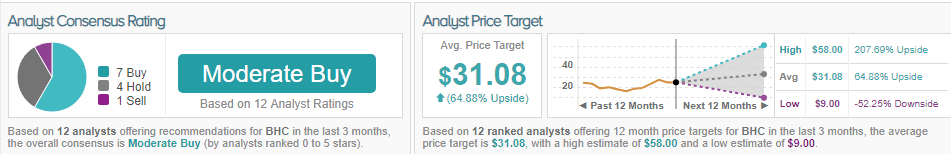

Analysts are not all in agreement when it comes to BHC. TipRanks data shows us out of 12 analysts who are watching BHC eat and digest SGYP, 7 are bullish, 4 sidelined and 1 bearish. The consensus price target of $31.08 shows a potential 65% upside. For analysts, the crystal ball is cloudy on this one, but for Englander – opening a position worth more than $13 million on BHC – we’d say he’s got a good idea of what’s to come. (See BHC’s price targets and analyst ratings on TipRanks)