Dividends add value to a stock by offering investors a cash or stock payout simply for holding shares. Dividends are especially popular among long-term value investors since they provide a relatively stable income source, but they can also increase the value of stocks for day traders. Importantly, dividends are not free and can play an important role in the price of a stock in both the short-term and the long-term. Thus, it is important for day traders and long-term investors alike to understand where dividends come from and how they can affect stock prices.

How are Dividends Paid?

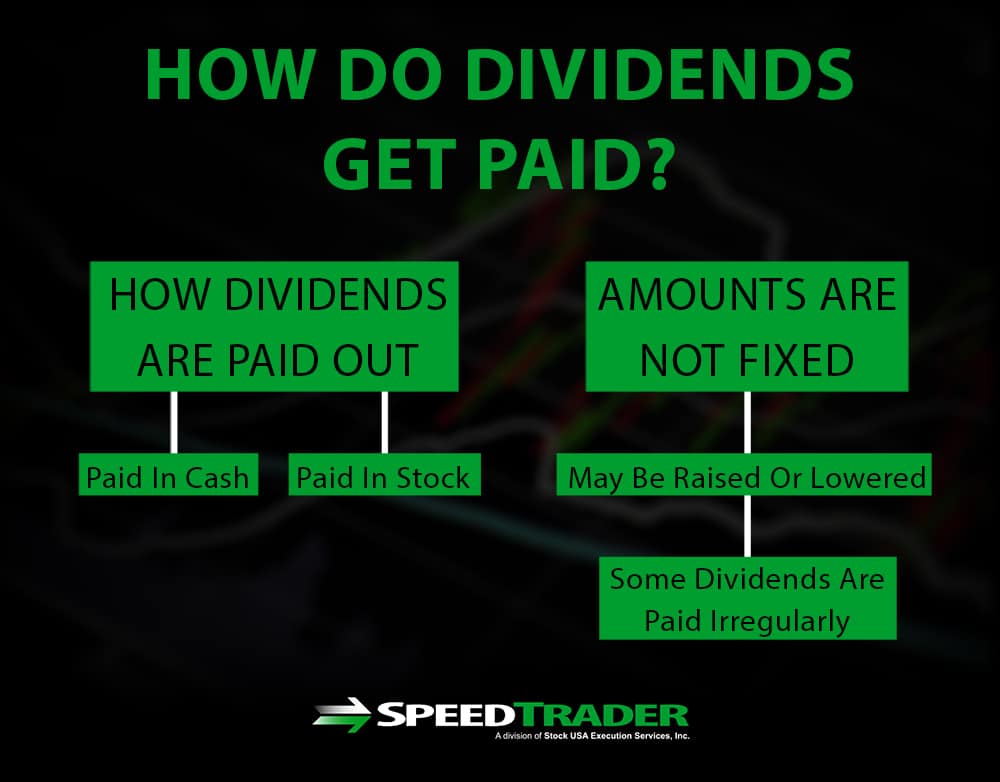

Not every company pays dividends, but those that do typically pay them as a way to thank shareholders for their investments and to encourage further investment. There is a lot of variation in how dividends are paid out by different companies, or even by the same company over time. For example, while most dividends are paid in cash, they can also be paid in stock. In addition, dividend amounts are not fixed – companies may decide to raise or lower their dividends at any time, depending on their recent profits and whether they want to use excess profits to fund a dividend or to fund other projects. Some companies that pay dividends also do so irregularly, while others do so on a set monthly or quarterly schedule.

Dividends and Short-term Price Movements

Investor Sentiment

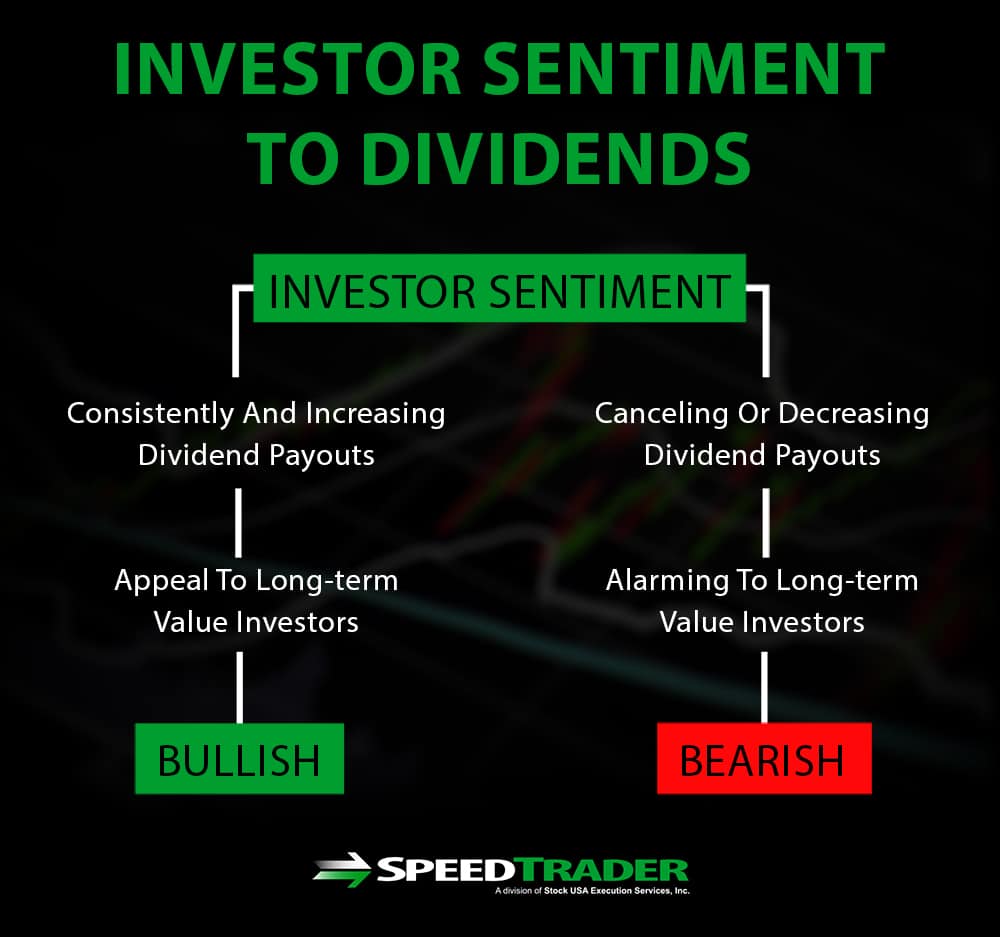

One of the benefits and perils of a company issuing dividends is that dividends can have a significant effect on investor sentiment about that company. A company that is known for issuing consistent dividends over many years is likely to appeal to long-term value investors and to be seen as a steady, mature, and profitable company by investors, which can help drive up the share price over time. Investor sentiment may be even more favorable, increasing demand for the stock, if the company is known for consistently increasing its dividend payouts and day traders can potentially profit off of dividend increase announcements.

On the other hand, cancelling a dividend payment, decreasing one or more dividends, or even stopping dividend increases can spook investors as a signal that the company is in trouble – regardless of whether that is actually the case, or the company simply wanted to put the dividend money towards another purpose to create future value. The ensuing drop in share prices may far exceed the lost value from reduced dividend payouts, regardless of how other fundamentals of the stock have changed. These sharp negative swings in investor sentiment due to changes in dividend payouts can provide lucrative opportunities for day and swing traders to profit.

Ex-dividend Date

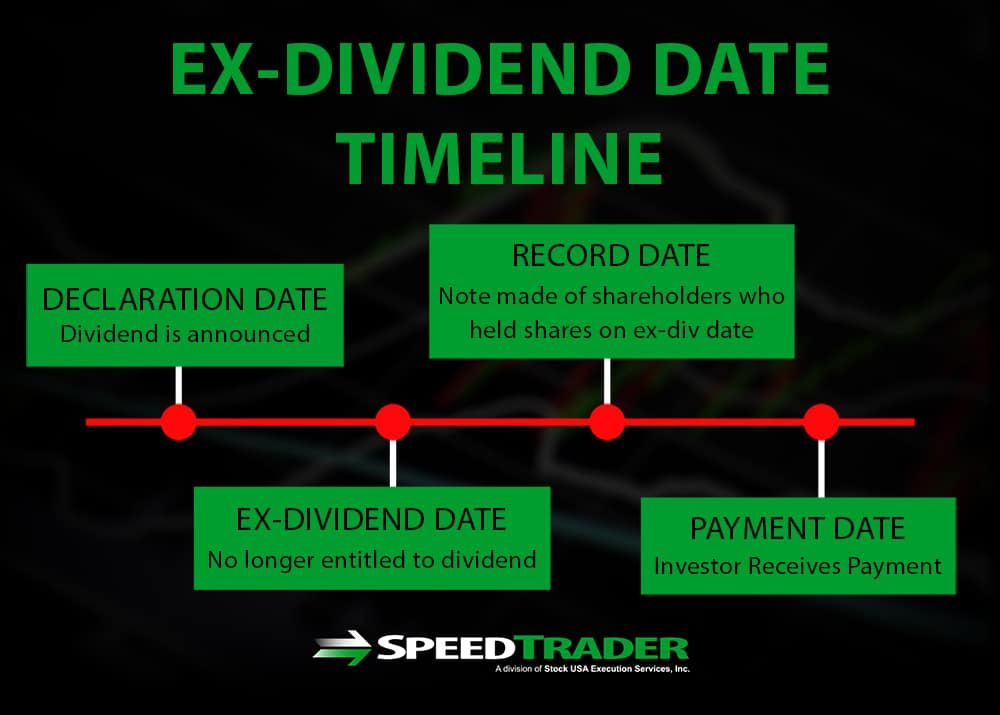

The ex-dividend date, which is the date from which new shareholders are no longer eligible to receive the upcoming dividend payout, is an important short-term driver of a stocks’ price. A stock’s price will typically increase in the days leading up to the ex-dividend date to account for the added value of the dividend itself. On the ex-dividend date, the stock price may fall to compensate for the lost value now that the dividend payout is not included with purchasing new stock.

While the price change around ex-dividend dates may be small, trading around ex-dividend dates to collect dividends or play the anticipated change in stock price can be an effective strategy for short-term traders.

Stock Dividends

When dividends are paid out in stock rather than cash, this increases the number of shares outstanding of the company without increasing the company’s value. Thus, all current shares lose a small amount of value, which can drive the price of the stock down to adjust for the new distribution of value. The amount of value loss per share depends on the total number of new shares issued, but the effect is typically small.

Dividends and Long-term Valuation

Dividend Yield and Dividend Payout Ratio

The dividend yield and dividend payout ratio are two metrics used to evaluate the value of anticipated dividends from a company. The dividend yield measures the annual payout in dividends than an investor can expect to receive per share held:

Dividend Yield = Annual Dividends per Share / Price per Share

The dividend yield is typically used to compare the value of dividends between two companies for investors. However, note that the dividend yield fluctuates with share price, and may appear to decrease even as share price increases and the overall return on your investment improves.

The dividend payout ratio does a better job of indicating the financial health of a company and whether it will be able to sustain its dividends into the future:

Dividend Payout = Annual Dividends per Share / Earnings per Share

A stable dividend payout, and one that is comparable to other dividend-issuing companies in the same industry, is usually a good indicator that a company will be able to maintain its dividends. Short-term traders may view an excessively high dividend payout as a signal to short the stock in anticipation of reduced dividends in the future.

Dividends per Share

Dividends per share indicates the actual value that a company is paying out in dividends each year. Changes in the dividend per share are typically what investors look at to determine whether a company is performing well or poorly based on its dividends.

Dividends per Share = (Total Dividends – Special Dividends) / Shares Outstanding

The dividends per share can thus be used to track changes in a company’s dividends over time and can be used in combination with dividend payout to determine how what fraction of the company’s earnings per share is paid out to investors in dividends.

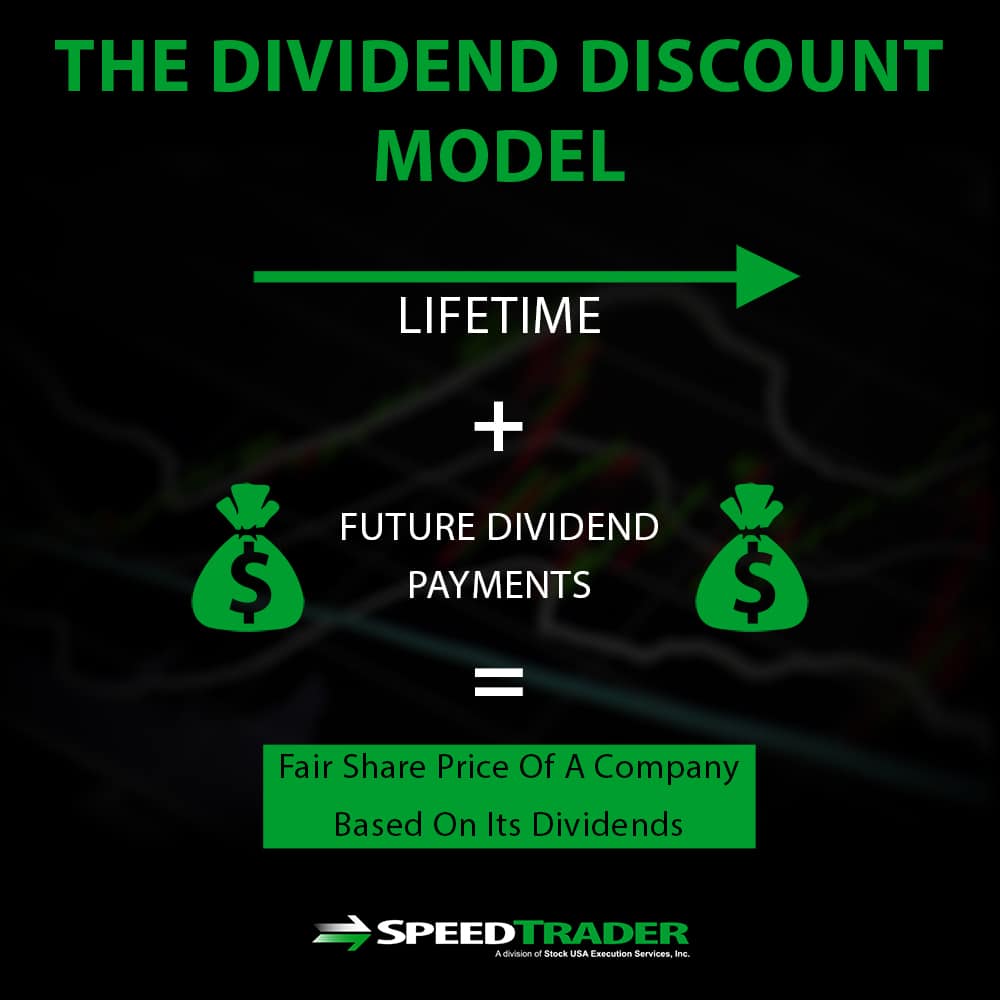

Dividend Discount Model

The dividend discount model, or Gordon growth model, is popular among long-term value investors as a way to determine the fair share price of a company based on its dividends. According to this conservative valuation model, stocks are essentially worth what they will pay out to investors over their lifetime. Thus, the dividend discount model is extremely dependent on assumptions about the rate of future dividend increases, future interest rates, and a company’s growth. Note also that the dividend discount model does not take into account the value of an increase in the stock’s price over time relative to what it was purchased for.

Although this model is used primarily among long-term investors, it can also be useful for short-term investors as a metric of where a stock may find support.

Conclusion

Dividends are an important part of stocks as they can affect both short- and long-term price movements. Dividends have a significant effect on investor sentiment and actual share value. In addition, long-term investors often look at dividends as a primary component of the fair price of a company’s shares, while short-term investors can incorporate dividend payouts into their trading strategies.