Stocks and bonds are constantly competing for investors’ dollars, and the stock and bond markets can impact each other in complex ways. Understanding the difference between stocks and bonds, and recognizing whether they are likely to move in tandem or in opposite directions, is important for traders who are looking to maximize their profits under the widest possible variety of market conditions.

What is the Bond Market?

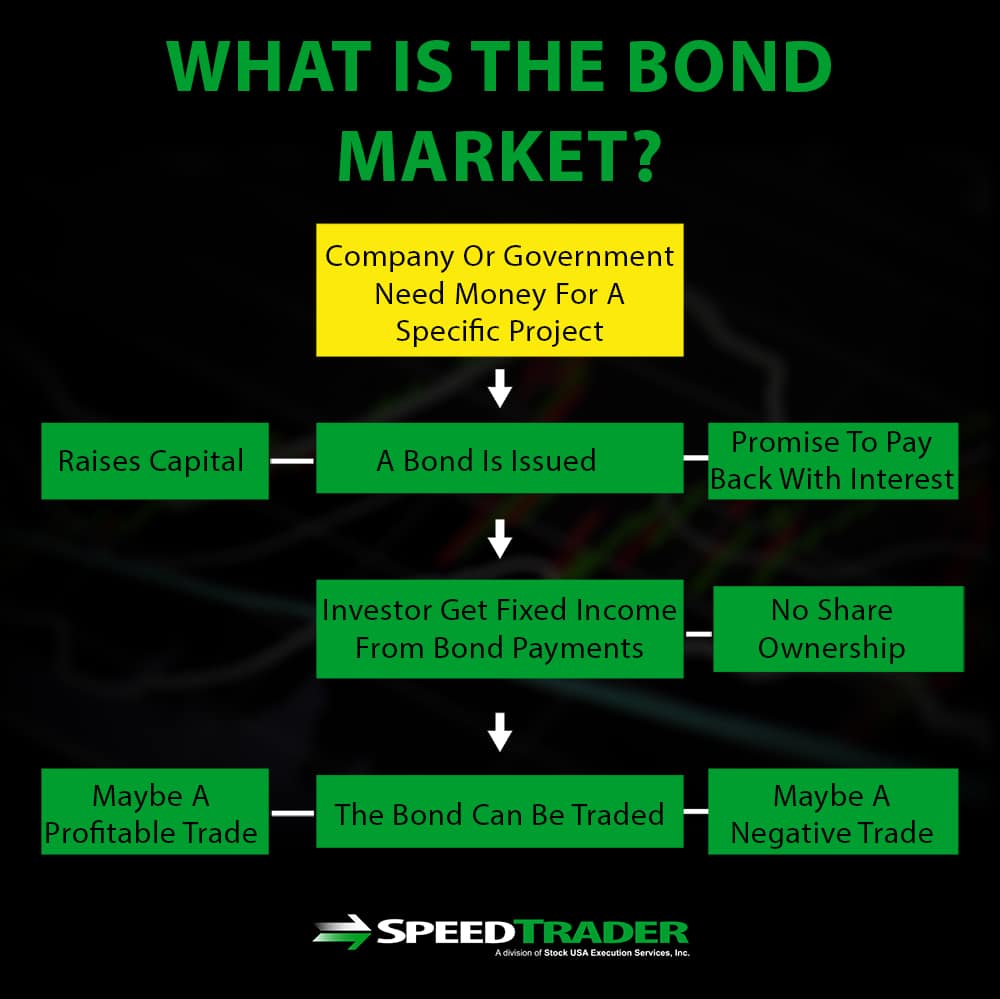

A bond is essentially a receipt for a loan made by an investor to a company or government, indicating that the loan is to be repaid in the future. Companies and governments typically issue bonds to finance a specific project, receiving money in the short term in exchange for a promise to pay back the loan with interest. Unlike stocks, bonds do not give the bond holder a share in the underlying company or government, but rather a fixed income from payments towards the bond’s value with interest.

The bond market exists because once a bond is issued to an investor, that investor can then turn around and trade it for a profit or loss. The bond market is not a single market, but rather a catch-all term for the collection of different bond markets. Markets for corporate bonds, government bonds, and municipal bonds are the markets most commonly referred to by the term “bond market,” although these are not the only types of bonds available to trade.

How Do the Stock and Bond Markets Interact?

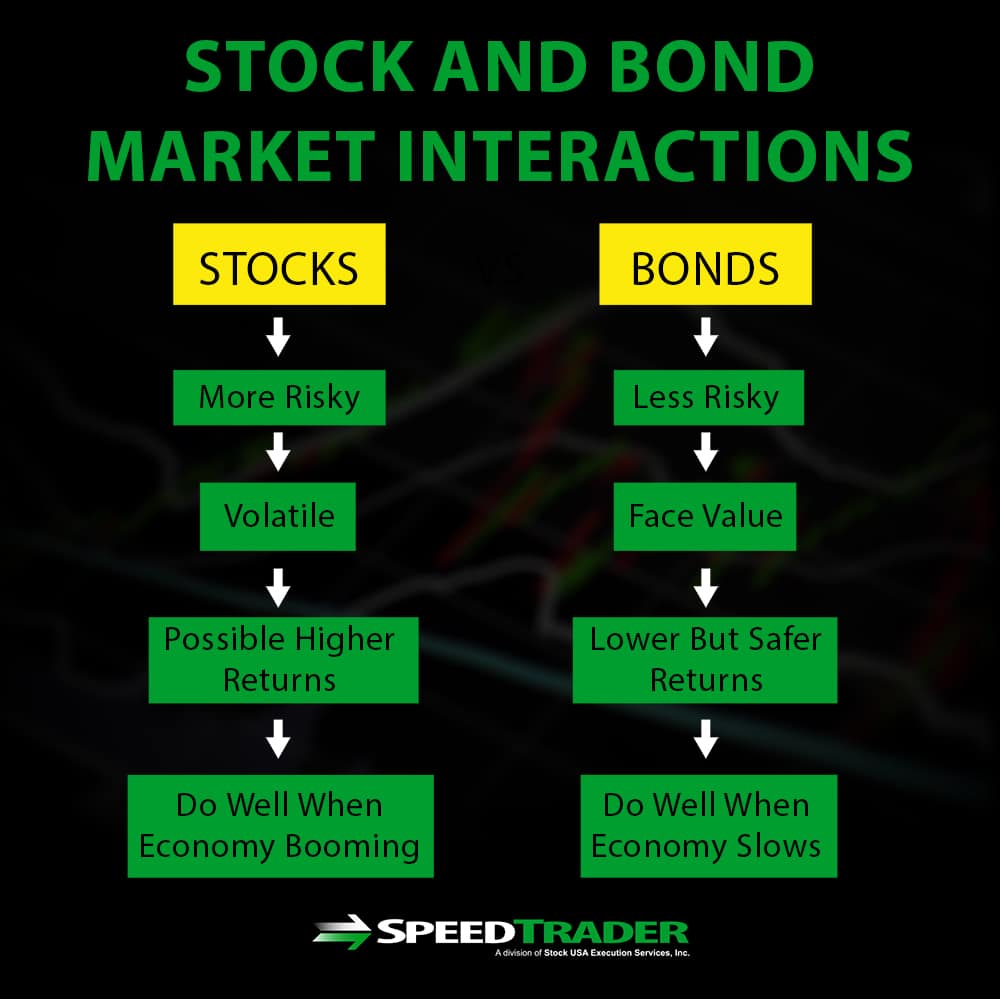

To understand how stock and bond prices can affect each other, it is essential to understand that stocks and bonds are competing for investors’ money.

Stocks are considered more risky than bonds, since they can lose value rapidly depending on a company’s fortunes and the stock market is typically much more volatile than the bond market.

Bonds, on the other hand, are controlled by their face value – the value of the loan that the bond was initially issued for. When a bond eventually reaches maturity, the bond issuer will pay the bond holder at the face value of the bond, regardless of economic conditions at the time of maturity.

Bull and Bear Markets

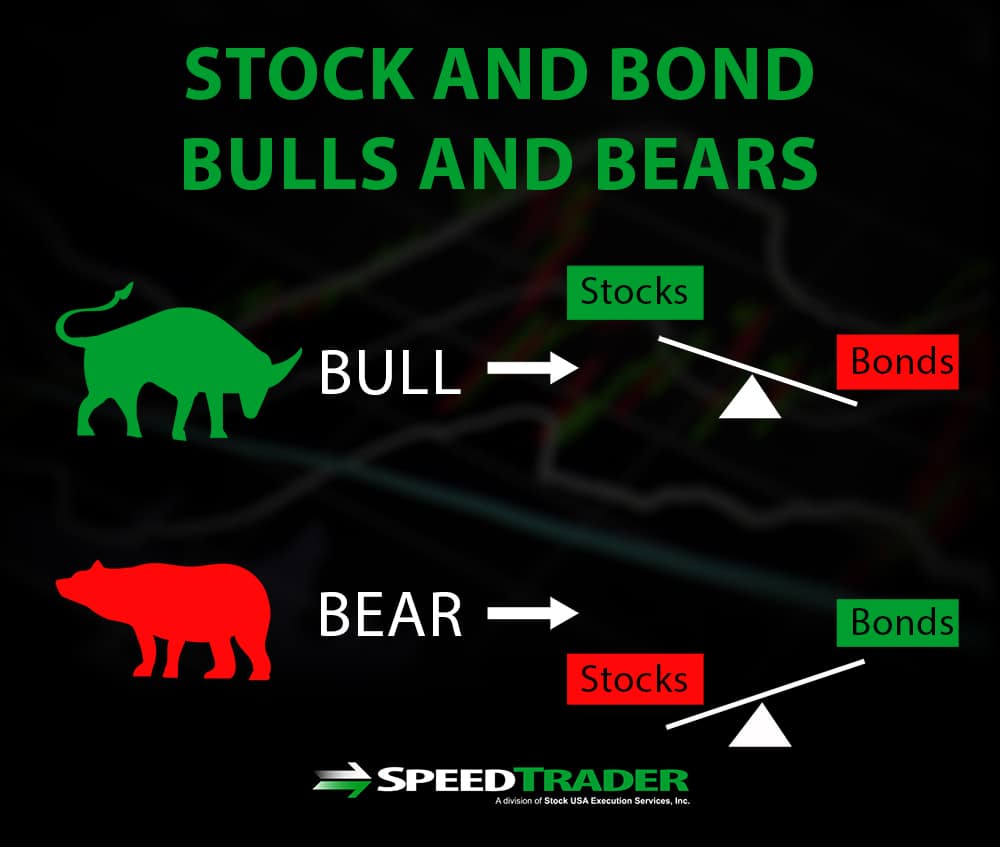

During bull and bear markets, stock and bond prices typically move in opposite directions. In a bull market, investors are likely to see stocks as less risky because the stock market as a whole is performing well. That means that stocks potentially offer a greater reward-risk ratio, so investors will move their money from bonds to stocks, increasing the price of stocks and decreasing the price of bonds.

The opposite is true in bear markets. As stock prices decline, risk-averse investors looking for a safe haven will see bonds as a better investment than bonds. This drives the price of bonds up and further drives the stock market down.

Interest Rate Changes

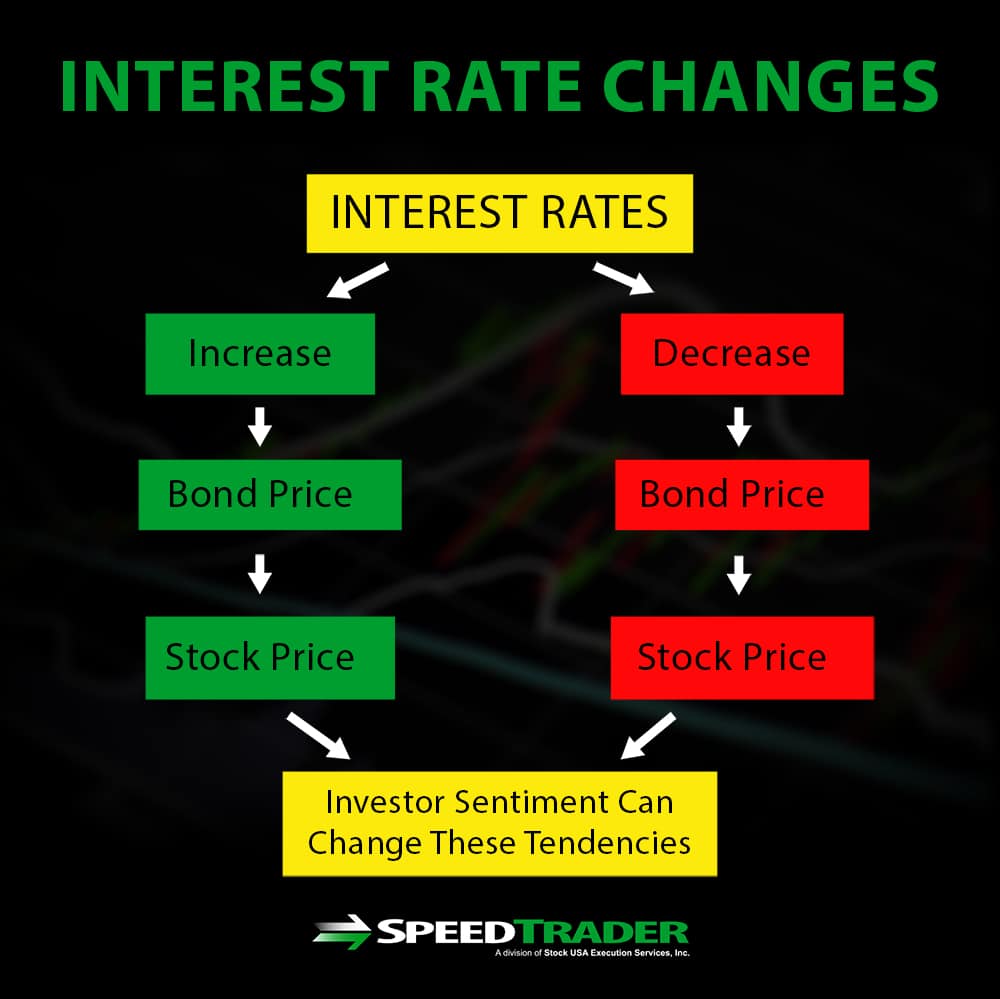

Interest rate changes complicate the relationship between stocks and bonds. Under certain conditions, interest rate changes may cause stock and bond prices to move in the same direction. But, this is not always the case.

Interest rates have the strongest effect on bond prices. The effective yield of a bond is reduced when investors could achieve close to the same profit without paying for a bond as interest rates rise. Thus, bond prices fall when interest rates rise, and rise when interest rates fall.

At the same time, interest rate changes may or may not have a strong effect on the stock market. In theory, falling interest rates will push stock prices up since lower interest rates allow consumers to spend more and companies to borrow money to expand. Rising interest rates constrict the economy, causing stock prices to fall.

If interest rates have a strong effect on the stock market, then lower interest rates will cause both stock and bond prices to rise, while higher interest rates will cause both stock and bond prices to fall. However, the stock market does not always respond strongly to interest rate changes because of investor sentiment, a strong or poor earnings season, or a multitude of other factors. In that case, it can be difficult to predict whether the bond and stock markets will move in the same direction in response to an interest rate change.

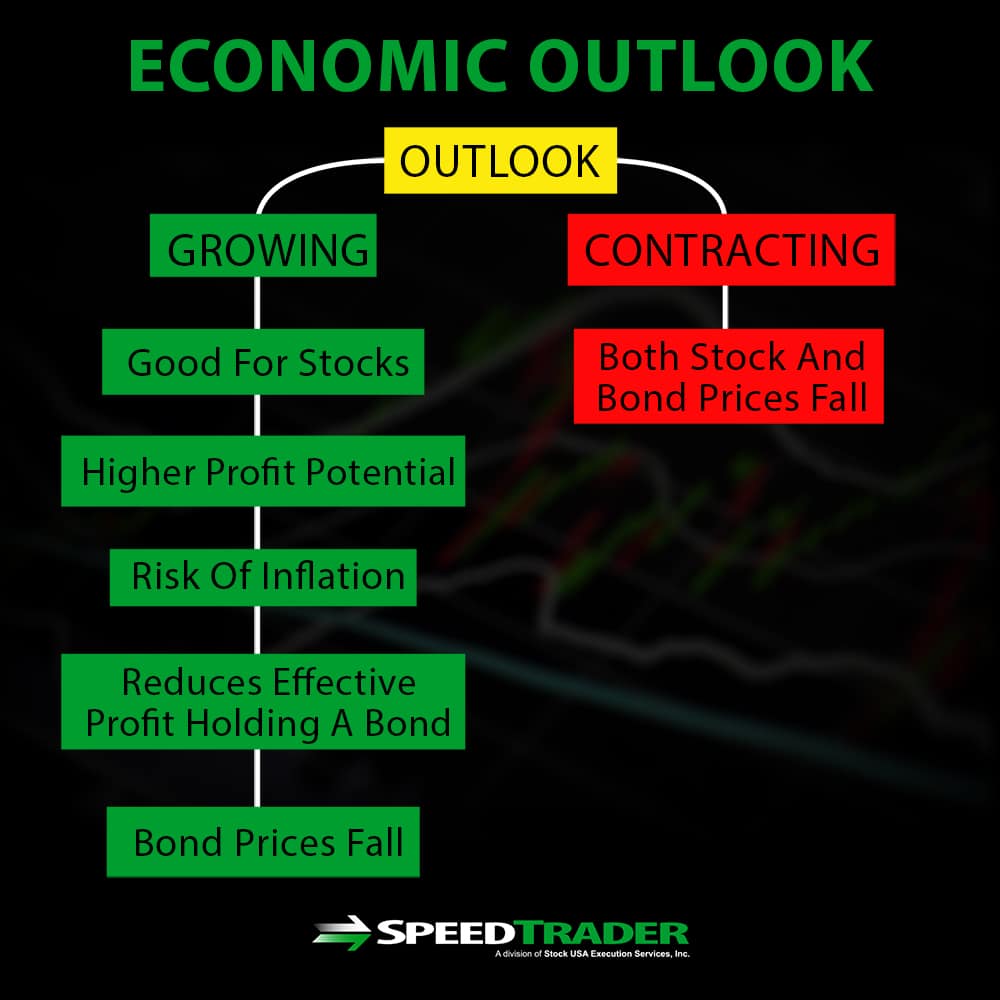

Economic Outlook

Whether the economy is forecast to grow or contract can also affect investors’ choice between stocks and bonds. Economic growth is typically good for stocks, since it means higher profit potentials for corporations in the future. At the same time, economic growth carries the risk of inflation, which reduces the effective profit from holding a bond as the bondholder will be paid the worth of the bond prior to inflation. Thus, forecasted economic growth, like a bull market, can cause stock prices to rise as bond prices fall.

Note that the converse is not necessarily true, however, because monetary deflation is extremely uncommon even when the economy is expected to contract. Thus, a poor economic outlook can cause both stock and bond prices to fall, and investors’ sentiment about which of the two markets presents a safer option may determine which falls harder.

Conclusion

The stock and bond markets have a complicated relationship that depends on how the stock market is performing, expected trends in interest rates, and the national economic outlook. While stocks and bonds are competing for investors’ money, and thus stock and bond prices often move in opposite directions, there are specific cases when both markets can rise or fall together.