There Are Two Popular Stereotypes of Bitcoin Investors

The first is that bitcoin users are tech/finance people who are made ridiculous amounts of money from investing in bitcoin before the bubble. This is true. The second is that a lot of bitcoin users are engaging in drug dealing, illegal gambling, and money laundering. The second perception is somewhat true also. A University of Sydney study in January held that 44 percent of bitcoin transactions are likely illegal in nature. What many crypto investors are failing to recognize is that a much, much higher percentage of bitcoin user demand than they think is related to gambling, drugs, and fraud. The government is squeezing this at both ends by going after bad actors and legalizing lesser evils like sports betting and marijuana. Also, the creation of new (often fraudulent) cryptocurrencies continually increases the supply of coins. Falling demand and rising supply equal lower prices, and major cryptocurrencies have been crushed since the start of 2018 as speculators realized they had been played and cashed in their chips. If you still own bitcoin or other cryptocurrencies like ethereum, litecoin, or ripple, I’d sell them.

Bitcoin prices have plunged since the start of the year.

Much of Bitcoin Demand Is for Illegal Products and Services

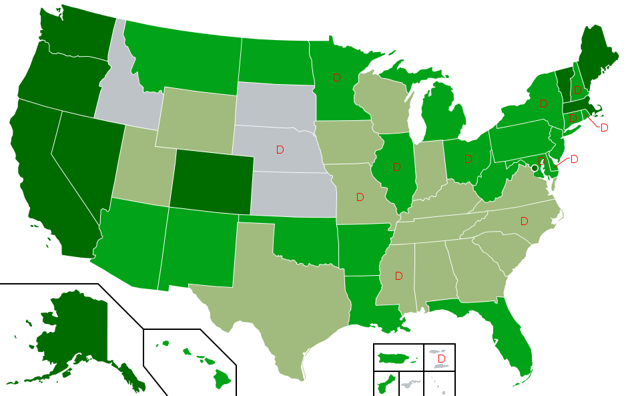

Many of the first users were libertarians and academic types, who believed that a viable cryptocurrency that could take power out of the hands of the government and place it in the hands of its citizens. Bitcoin slowly gained traction among its early fan-base of programmers, libertarians, and academics in 2009 and 2010. This all changed with the founding of Silk Road in February 2011. When Silk Road was founded, the price of bitcoin was around 1 dollar per coin. In June, Gawker published an article about Silk Road, titled “The Underground Website Where You Can Buy Any Drug Imaginable.” Bitcoin hit $31 within one week of the article going live, up over 3000% from February. By the time Ross Ulbricht was arrested, every delinquent high schooler and college student in America had heard of Silk Road and bitcoin. But this segment of demand may not last. Marijuana is by far the most popular illegal drug, and it is marijuana that is seeing a huge boost in the number of states legalizing it. (The states marked D have decriminalized marijuana, dark green is legal, medium green is medical, light green is legal CBD oil).

Another source of demand for bitcoin has come from the shadowy market of online gambling. The University of Sydney study did not focus much on gambling, which is more widely legal in Australia than the United States. Other studies point to the popularity of bitcoin-only online casinos. Customers are currently placing 337 bets per second in various bitcoin casinos. That’s over 29 million transactions per day! Many popular US facing sports betting websites such as 5dimes and Bovada used to rely on credit cards to take deposits from customers. Now they encourage their customers to deposit in bitcoin.

Online gambling is a 50 billion dollar per year industry globally. If 25 percent of online gambling revenue comes from the United States, which is a reasonable assumption, then online betting customers might be one of the largest single sources of bitcoin demand. With New Jersey and Delaware being the first new states to legalize sports betting and plenty of other states clamoring for a piece of the action, bitcoin is likely to see a drop in demand. If it is indeed true that 44 percent of bitcoin transactions are illegal, and most illegal transactions revolve around weed and sports betting, then bitcoin demand could drop significantly. I’m making a distinction here between the ability of cryptocurrencies to be a medium of exchange and a store of value. I think bitcoin especially will continue to be used as a medium of exchange, but less as an investment going forward.

What About Demand from Other Countries?

Bloomberg did a fantastic graph here showing the currencies being exchanged for bitcoin over time. Over half of bitcoin demand currently comes from the United States. The first big wave of demand for bitcoin came from domestic drug users. But by its peak in early 2017, over 95 percent of bitcoin volume came from China. I’m not sure exactly why this was, but it seems likely to me that people were using bitcoin mining/investment to get money out of China. It certainly isn’t the only way to move capital out of China, but likely was an effective one nonetheless. I’m not sure how else Yuan transactions could account for 95 percent of volume at one point. By March 2017, Yuan volume accounted for less than 10 percent of the total. As soon as Chinese Yuan transactions dropped, the percentage of transactions in Japanese Yen and U.S. dollars surged. Is there a link? I’m not entirely sure. But demand from China has dried up.

Crypto also seems to be popular with countries that have a hard time getting their hands on hard currency, like Venezuela and North Korea. They likely either mine or simply steal the currency, then exchange it for hard currency on the black market. While bitcoin is much more volatile than reserve currencies like the U.S. dollar and Euro, it is more stable than soft currencies issued by third-world countries. This is a source of demand, but currencies other than the Dollar, Yen, Euro and Korean Won represent less than 3 percent of total volume.

New Cryptocurrency Is Flooding the Market

Early adopters of cryptocurrencies envisioned a currency free from inflation, debasement, and theft. Their ideas did not hold up to reality. Bitcoin exchanges have been wracked by theft since their very inception. Bitcoin’s source code has inflation built in (although total supply is eventually limited to 21 million coins, new coins are added every day until then), and the Bitcoin cash fork built in even higher inflation for BTC cash. Early investors were able to make a fortune in bitcoin because the demand for bitcoin as a medium of exchange for drugs, gambling, etc. was much higher than the supply of bitcoin. Then speculators came in, making outsized profits off of successively greater fools buying in. Later, University of Texas professor John Griffin found that over half of the rise in bitcoin was due to old-fashioned market manipulation. He had this to say about the surge, “Our research would indicate that there are sophisticated people harnessing investor interest for their benefit.”

Rising prices drew the attention of the get-rich-quick crowd–unsophisticated investors who poured money into crypto. Then the pros took advantage, selling naive customers new cryptocurrencies in exchange for cold, hard dollars. The Wall Street Journal ran a piece identifying 271 coin offerings as potentially fraudulent. If a typical pump-and-dump stock fraud is a short con, the cryptocurrency craze may go down as one of the most epic long cons of all time. Now there are thousands of cryptocurrencies competing for consumers’ attention. You give them your dollars, and in return, they give you new, flashy cryptocurrencies created from thin air. With all the new supply pouring in, it’s a wonder bitcoin is only down 60+ percent instead of 90+ this year. More speculators are likely to get frustrated and sell over the next 12 months, further depressing the price of cryptocurrencies. As a medium of exchange, bitcoin and a few other cryptocurrencies likely have a future. As a store of value, they are a disaster.

Bitcoin Likely Isn’t a Good Investment at This Point

Cryptocurrencies are going to trade at the intersection of their real supply and demand in the long-run. The market is in the process of discovering what the fair price is. Bitcoin does not earn ongoing profits, and it does not pay dividends or rent. The same way that gold has been shown to dramatically underperform stocks and commercial real estate over time, bitcoin is likely to return far less than the stock market. Bitcoin could fall plenty further before it finds equilibrium, and some lesser cryptocurrencies may end up worthless. I recommend staying out of the entire mess.