Time Decay

As an option approaches its expiration date, there is less time to realize a profit – or additional profit – before the option expires. As a result, options lose value as they get closer to their expiration dates. This is known as time decay.

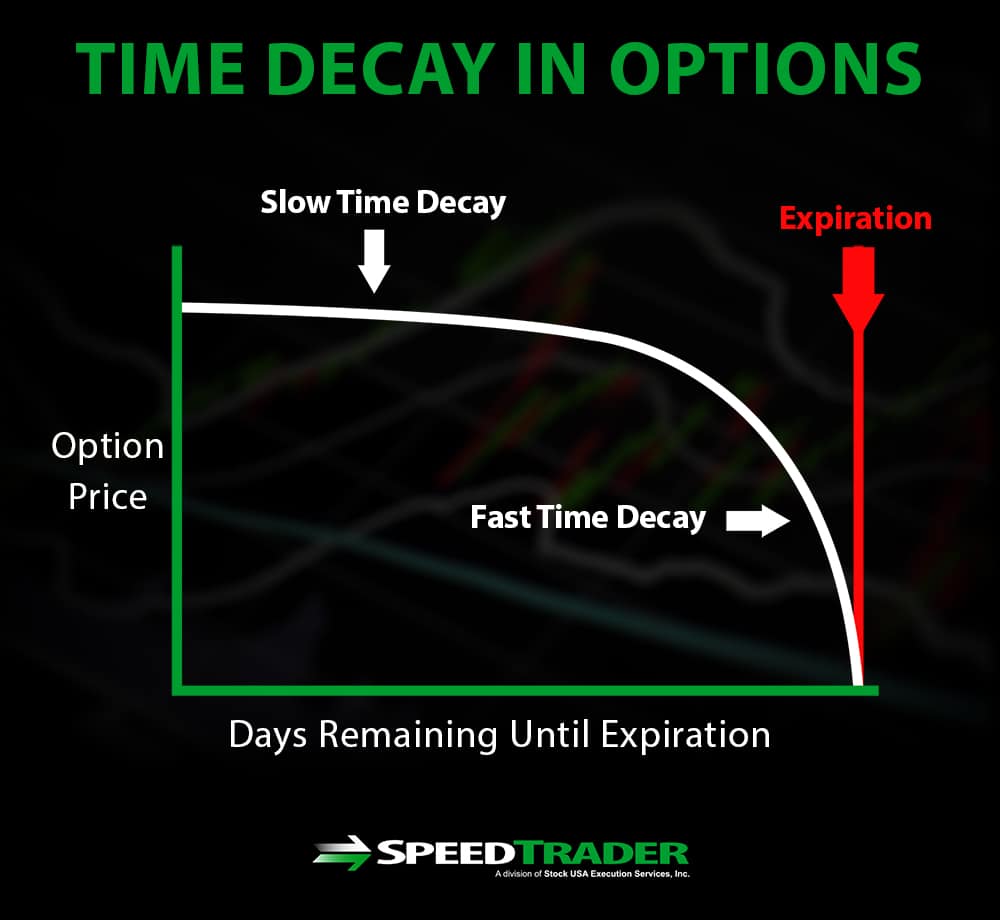

Time decay can be observed in the price of an option for which the underlying asset is constant in price. For example, if the underlying stock or other asset remains at a price just below the strike price, the price of the option will not remain constant as well. Rather, the option will decline in value as the expiration date approaches, with the rate of this decline accelerating as the expiration date draws nearer.

What is Time Decay?

Time decay can refer to either the general decline in the value of options as they approach their expiration dates or specifically to the rate of price decrease for a specific option. The reason that time decay occurs is that as an option’s expiration date approaches, there is less time remaining for changes or volatility in the market to drive the price of the underlying asset higher relative to the option’s strike price. Furthermore, the value of an option after its expiration date drops immediately to zero. Because of this, the incentive for options buyers to purchase an option diminishes as its expiration date nears, driving down demand and the price of the option.

Why Time Decay is Important

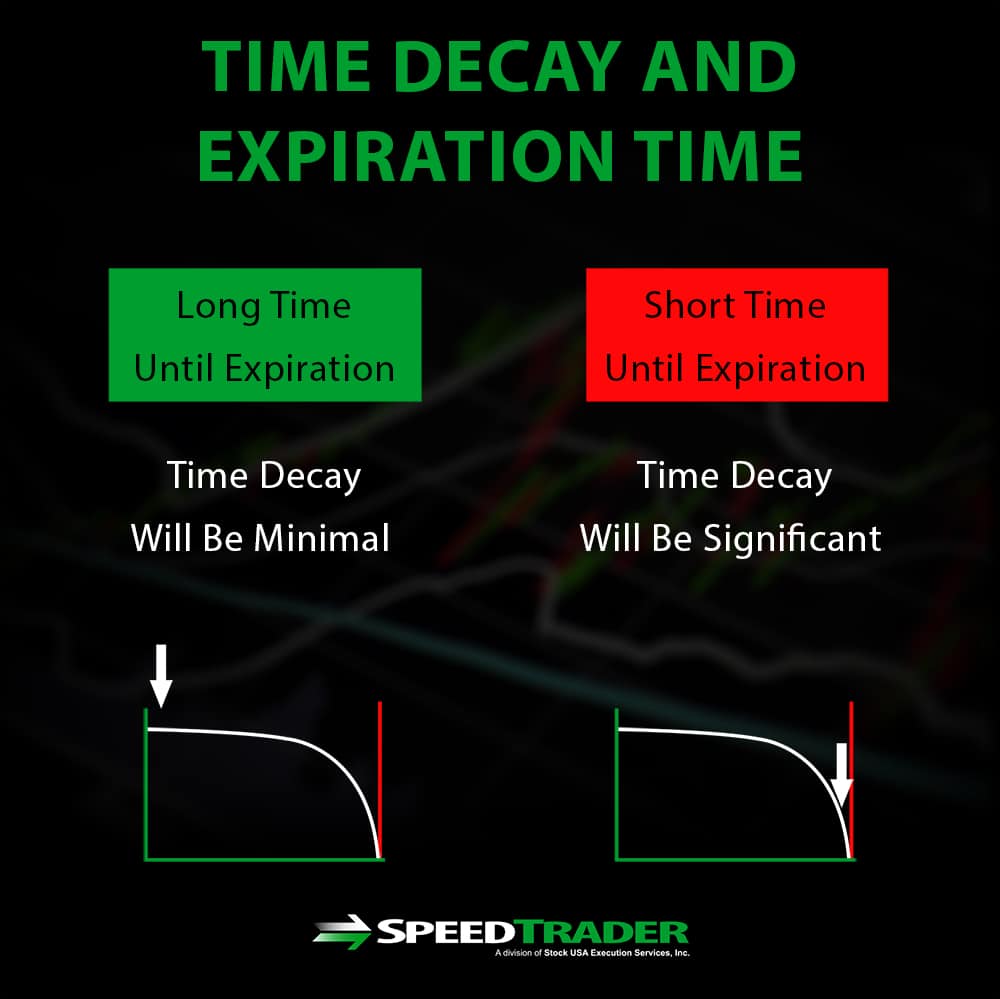

Time decay is important to options traders because it can have a significant effect on the price of an option, especially in the days and weeks before the option’s expiration date. If an option has a long time until expiration, time decay will be minimal because potential options buyers have plenty of time to realize a profit from the option. On the other hand, options traders who hold options for an extended period will see time decay begin to play a role in the market value of their options.

This means that options traders who are looking to sell, rather than execute, an option cannot simply hold an option until just before its expiration date. Doing so means risking a precipitous decline in the market value of the option, especially if it is below its strike price.

More generally, time decay is one of the most important drivers of options’ premiums. For at-the-money options on a single stock, for example, an option that expires in one year will have a much higher premium than the corresponding option that expires in one month.

Keep in mind that time decay is not a linear loss in value. Instead, time decay accelerates as an option’s expiration date approaches. This poses a significant risk for options traders who trade with short-term options or who decide to hold onto an option for extra time because of market volatility or anticipated financial events.

Measuring Time Decay

Time decay, specifically the rate of change in the value of an option as it approaches its expiration date, is symbolized as the options Greek theta. Theta is always a negative number since time only moves in one direction and becomes larger (that is, more negative) as the expiration date of an option approaches. For example, if theta was “-0.10”, the option price would decrease in value by $0.10 every day solely due to time decay (not accounting for other factors such as the movement of the underlying asset).

How Time Decay Can Affect More than Options

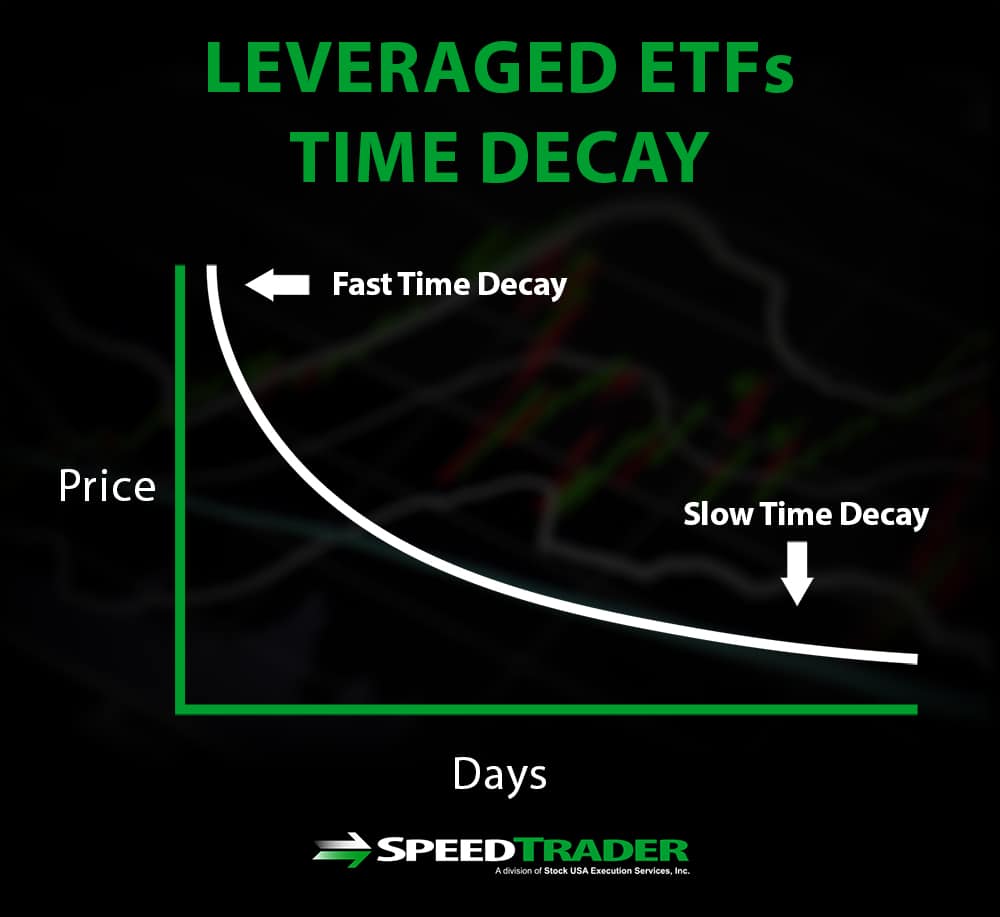

Time decay can also affect ETFs, which invest in a portfolio of options in the same way that a traditional ETF invests in a portfolio of stocks. These constituent options are each subject to time decay, such that the ETF itself will decline in value as its options approach their expiration dates.

The UVXY and TVIX leveraged ETFs, which trade derivatives of the VIX index, illustrate this effect. The UVXY and TVIX indices always decline in value over the long term because of time decay, even though the VIX index itself trades within a relatively tight price range.

Conclusion

Time decay is an important variable in understanding and trading options since it is constantly pushing the price of options downward. Time decay, measured as the Greek theta, increases as an option’s expiration date approaches, making it increasingly risky to buy short-term options or to hold long-term options close to their expiration. Keep in mind that time decay can also affect the price of other securities, such as leveraged ETFs.